Understanding How Credit Report Repair Functions to Enhance Your Financial Health And Wellness

The procedure includes identifying errors in credit history records, disputing errors with credit bureaus, and discussing with financial institutions to deal with superior debts. The inquiry continues to be: what certain methods can individuals use to not just correct their credit report standing however additionally make sure lasting monetary stability?

What Is Credit Report Repair?

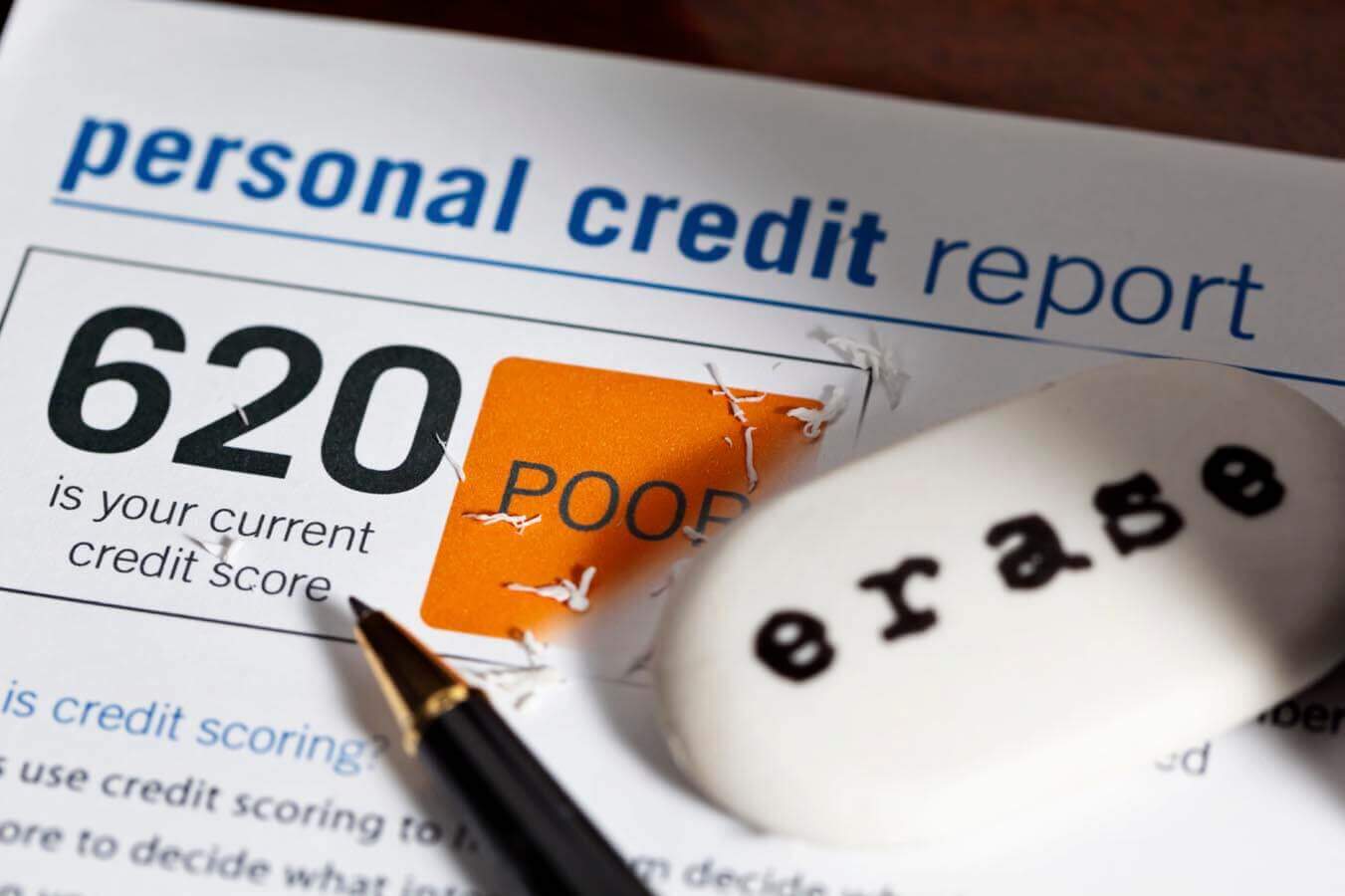

Debt repair refers to the process of enhancing an individual's credit reliability by attending to errors on their credit scores record, discussing financial debts, and adopting far better financial practices. This multifaceted strategy intends to improve an individual's credit rating, which is a vital aspect in securing finances, bank card, and favorable rates of interest.

The credit repair service procedure commonly begins with an extensive review of the person's credit rating report, permitting for the identification of any kind of mistakes or discrepancies. The individual or a credit scores fixing professional can launch conflicts with credit score bureaus to remedy these issues once mistakes are determined. In addition, negotiating with lenders to resolve outstanding financial debts can further boost one's economic standing.

Additionally, embracing prudent economic methods, such as timely bill payments, reducing credit rating usage, and preserving a diverse debt mix, adds to a much healthier credit score account. Overall, credit repair service functions as a vital strategy for individuals seeking to gain back control over their economic wellness and secure far better loaning opportunities in the future - Credit Repair. By participating in credit repair work, people can lead the way towards accomplishing their monetary objectives and enhancing their overall lifestyle

Common Credit Scores Record Mistakes

Mistakes on credit history records can significantly affect an individual's credit report, making it essential to recognize the usual sorts of inaccuracies that may emerge. One prevalent issue is inaccurate personal information, such as misspelled names, wrong addresses, or inaccurate Social Security numbers. These errors can bring about confusion and misreporting of creditworthiness.

One more usual error is the reporting of accounts that do not come from the individual, commonly due to identification burglary or clerical errors. This misallocation can unjustly lower an individual's credit report. In addition, late settlements might be erroneously tape-recorded, which can take place as a result of settlement handling errors or wrong coverage by lenders.

Debt limitations and account equilibriums can also be misstated, leading to a distorted sight of a person's credit history usage ratio. Recognition of these common mistakes is important for effective credit rating management and fixing, as resolving them immediately can assist individuals preserve a much healthier economic account - Credit Repair.

Steps to Dispute Inaccuracies

Disputing mistakes on a credit history report is a crucial process that can help recover an individual's creditworthiness. The primary step includes acquiring an existing copy of your credit history report from all 3 major credit report bureaus: Experian, TransUnion, and Equifax. Testimonial the record carefully to recognize any mistakes, such as wrong account details, equilibriums, or payment backgrounds.

Once you have identified disparities, gather sustaining documentation that corroborates your cases. This might include bank declarations, settlement verifications, or communication with financial institutions. Next off, initiate the dispute procedure by calling the relevant credit history bureau. You can generally submit disagreements online, using mail, or by phone. When submitting your conflict, plainly detail the errors, supply your proof, and include individual identification info.

After the conflict is filed, the credit bureau will certainly investigate the claim, usually within 30 days. Maintaining accurate records throughout this process is important my sources for reliable resolution and tracking your credit report health and wellness.

Building a Strong Credit Score Profile

Exactly how can people effectively grow a durable credit score profile? Constructing a solid credit rating profile is important for protecting desirable economic possibilities. The structure of a healthy and balanced debt account starts with prompt expense repayments. Constantly paying bank card costs, financings, and various other responsibilities in a timely manner is vital, as repayment history significantly impacts credit history.

Moreover, keeping low credit rating application ratios-- preferably under 30%-- is important. This means keeping charge card equilibriums well below their limitations. Diversifying credit score types, such as a mix of rotating credit rating (credit cards) and installment financings (car or mortgage), can additionally enhance debt profiles.

Regularly keeping an eye on credit history records for mistakes is just as essential. People should examine their credit report records at least every year to recognize discrepancies and challenge any mistakes without delay. Additionally, preventing extreme credit inquiries can stop possible negative influence on credit rating.

Long-lasting Advantages of Credit Scores Repair Service

In addition, a more powerful credit score profile can facilitate far better terms for insurance coverage premiums and also influence rental applications, making it less complicated to protect housing. The mental benefits must not be neglected; people who efficiently repair their credit rating usually experience minimized stress and enhanced self-confidence in managing their funds.

Final Thought

In verdict, debt repair service serves as a vital device for improving financial wellness. By determining and disputing errors in debt records, individuals can fix errors that adversely affect their credit history ratings.

The long-term advantages of credit score repair work expand far past simply improved credit score scores; they can substantially boost a person's general monetary health and wellness.